Are your financial matters on the right track?

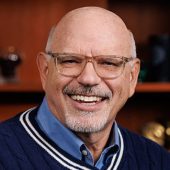

Certified Financial Planner Steve Repak teaches us biblical principles that will help us get fit for a healthy financial future from the .

Unresolved financial matters can often bring an unnecessary tension and stress into our lives, but there is a way to manage them in a way that is honoring to God. Steve shares sound advice for newlyweds,

“If we can start off on the right track it’s lot easier to stay on the right track. We get married and think that it is okay to get in get a bunch of debt. We want to buy the new refrigerator, we want to spend a lot of money and we’re all euphoric from the happiness of being married, but we really want to start off on the right track.”

Steve teaches us the an easy financial principle to remember, the 10-10-80 rule, that applies to everyone regardless of our income level.

“Give away the first 10%, save the next 10%, and you live off the rest.”

There are great benefits to applying this rule to our lives. Steve elaborates,

“You’re always giving to God, you’re always putting money away for savings, and you’re living off of less.

“That’s the cornerstone of personal finance, learning how to live on less. If I can live off of less, then I’m not going to get in credit card debt, I’m always going be able to build my savings, and I’m always going to be able to make the right decisions.”

Another important aspect of Christian financial stewardship is the giving principle. 2 Corinthians 9:7 says,

‘For God loves a cheerful giver.’

Are you a cheerful giver?

Many people only give because they feel obligated to do so, rather than giving freely from the heart. We are reminded that God doesn’t need our money, however, He does want our heart. Steve shares the benefit of giving with a cheerful heart,

“The people that are most joyous are the people that give the most…you’re going to be a lot more joyful if you’re giving.”

In addition to applying the 10-10-80 rule and giving with a cheerful heart, we also need to make sure that important legal documents are in place.

“You need to have your financial documents in order, for example; your wills, your power of attorneys, your living wills, your health care power of attorneys, etc. We think of it, ‘That’s what old people do, or people with a bunch of money have.’ The truth is that no matter how much money you have, you need to have your estate plan and documents together.”

These documents are extremely important to have, especially when life happens.

“If you become incapacitated you want to have somebody selected that has your same values and same principles to make decisions on your behalf.”

“You don’t want somebody else to decide where your kids are going or how your assets should be divided, you want to have as much say into that as possible, or at least have someone that you can designate that has the same belief values and the same faith as you do.”

God will provide our every need, even in the event of an emergency, but we need to steward the resources He has given us wisely in order to stay on the right track.